Views from Messari Mainnet, Part I: The rise of multi-chain ecosystems

From Sunday night to Wednesday night last week, three of us from Hartmann Capital attended crypto market portal Messari’s Mainnet conference. The biggest takeaway from the event is that crypto has come so far in only one year.

About 13 months ago, the dominant DEX Uniswap did not yet have a token and Sushiswap was implementing its vampire attack, stealing over a billion in liquidity. Curve’s CRV, which launched Defi token wars, deployed a little over 13 months ago. DeFi hardly existed a year ago. Across all chains, DeFi total value locked (TVL) is near all-time highs of $175 billion. Ethereum has $120 billion TVL, up 1,300% from a year ago, even while losing market share to the challengers.

Ethereum DeFi Total Value Locked. Source: DeFI Llama

Not only did DeFi TVL 20x, but the then almost non-existent NFT market is now worth billions. NFT market Open Sea volume has gone from zero to $3 billion per month, and cryptopunk average price is up 45,000% year on year.

Open Sea Volumes and Cryptopunk Prices. Source: Dune.xyz

Conference goers shrugged off the weak markets, filling room after room at the Marriott Times Square and the bars in the area and in Brooklyn with optimism.

There was optimism for play-to-earn games (Axie Infinity) and optimism for the potential for creators to truly monetize their craft and interact directly with their audiences, without the need for middlemen (Audius). Everyone was excited for the new scaling solutions: layer 2s for Ethereum (Optimism) as well as challenger “eth-killer” layer 1s (Terra and Solana). New decentralized permissionless and censorship-resistant DWeb (Arweave, Akash) were seen replacing the powerful privacy-xyz Bigtechs sooner than expected. Finally, we noticed a focus on privacy and keeping control of one’s own data (Secret Network, Oasis).

Positivity trumped negativity, even the regulatory and policy headwinds that emerged coincident to the conference. We heard very little of the Bitcoin maxi’s “have fun staying poor” (hfsp), and a lot more of a community vibe: “we’re all going to make it” (wagmi). Speaking of Bitcoin, there were actually refreshingly few sessions and few conversations on the conference floor or in the bars about the original cryptocurrency.

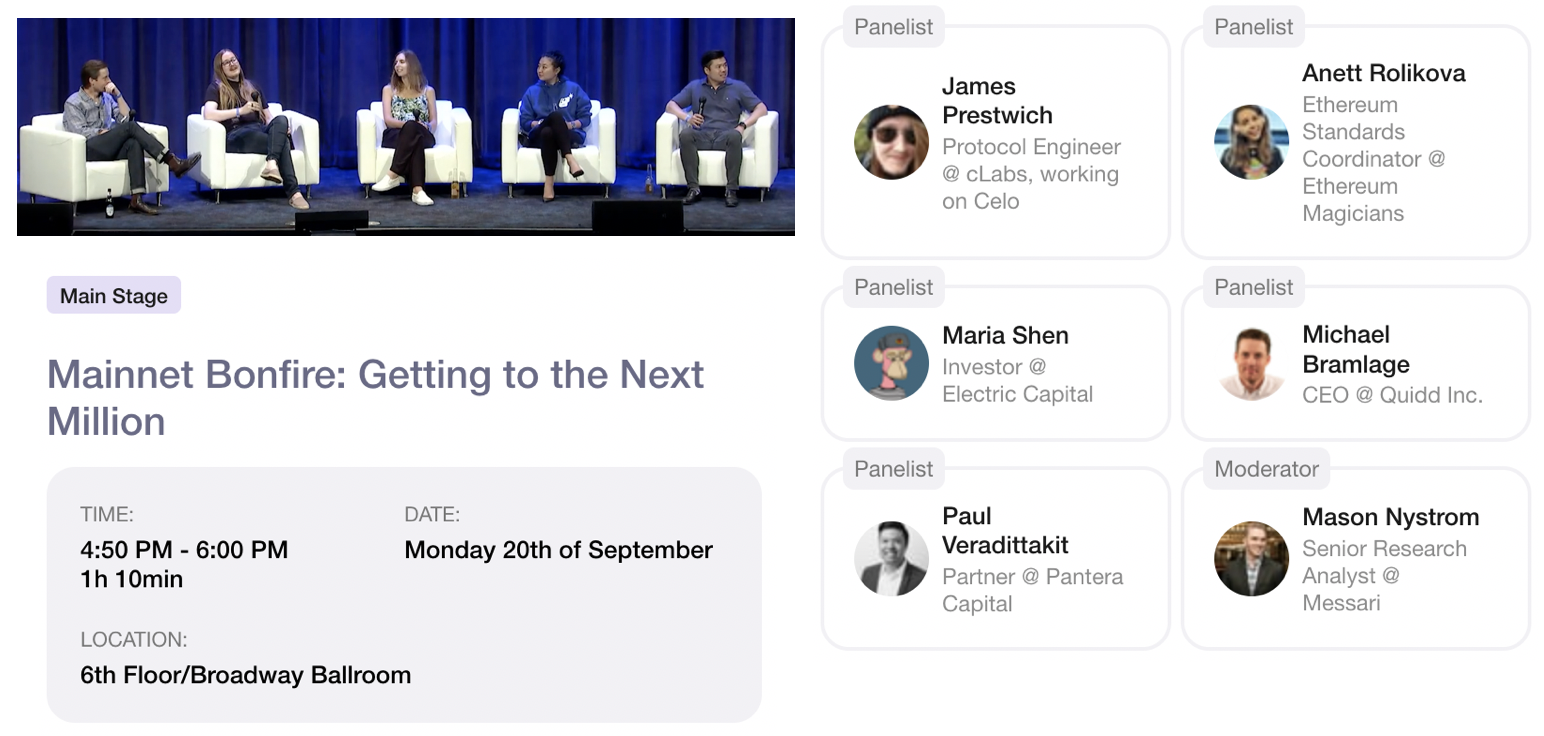

Crypto seems united in focusing on inclusion. Onboarding the next generation of crypto users was seen as the number one priority: How do we get through to the next million?

Source: Messari Mainnet

In and out of the conference, some very obvious themes emerged:

Regulation

Strong ecosystems will dominate: team, community, market, product.

The multi-chain world

The Decentralized Web (DWeb) is here

The rise of crypto gaming and play-to-earn

Institutions will recentralize DeFi

In this Part I, we dive deep into what we learned about the regulatory environment for crypto, the strength of the Terra and Solana ecosystems, and the multi-chain world on the way.

1. Regulation

While regulatory hurdles were always going to be on the agenda, there were several events that sparked even more impassioned debate at Mainnet: SEC subpoena rumors, SEC Chair Gary Gensler’s interview with the Washington Post live on the main stage, and Messari CEO Ryan Selkis’s rumoured run for the Senate.

Even now, the rumors are unconfirmed. Yet crypto feels that it is, unjustly, under attack.

“At the offices of the SEC”. Credit to @PacDAO.

Gary Gensler’s interview with the Washington Post was played on the main stage screens, such was the interest from the crypto community. He acknowledged the DeFi was innovating positively:

[DeFi platforms], I think, are really interesting innovations challenging the established business models.

Source: Washington Post

However, he was clear that more regulation and enforcement was on the horizon:

I think it would be better that [lending, staking and trading platforms] come in and we sort through, figure out how best to get them within the perimeter. We'll also be the cop on the beat and bringing those enforcement actions, as well.

The worry is that, as Elon Musk said this week:

It’s not possible to destroy crypto, but it’s possible for governments to slow down its advancement.

Between the earlier threats from the Infrastructure Bill, the SEC issuing a subpoena and Gensler’s attack on crypto blasting on Mainnet screens at his event, Messari CEO Ryan Selkis launched several tweetstorms where he announced a potential run for Senate.

At the same time, however, the conference mood was positive. Crypto is not going to be easily crushed by regulators in the US, or policymakers in China.

Most preferred the carrot to Selkis’s stick, however. Many commentators on stage, in the rooms and in the bars believed that, if anything, crypto’s decentralization ethos will triumph. Just today, for example, Fed Chair Powell clarified that he has no intention of banning crypto.

Messari’s own portal described the atmosphere thusly:

Mike Novogratz, the CEO of Galaxy Digital, felt that more dialogue was necessary: “It’s all about getting regulators to understand the importance of the space.” Kain Warwick of Synthetix agreed that regulators would be supportive of crypto’s innovations if they were better informed.

On the other hand, decentralized protocols feel under threat. Just yesterday AMM aggregator 1Inch blocked its UI to American residents, causing a slight panic.

At Hartmann Capital, we see the advantage of appropriate regulation, including KYC and AML checks as needed and investor protections on true securities offerings, but also believe that the industry could use more clarity. We also believe that there is an opportunity for Web3 and privacy solutions to decentralize the UIs that most use to access DeFi. If the blockchains, contracts and the UIs are in the “ether”, who can regulate? Under whose jurisdiction?

2. the Strongest ecosystems will dominate

In TradFi venture capital, we’re taught that the key ingredients for early stage success are team, market, and product. A strong team is a requirement as, if the product fails, there’s always the possibility of a pivot. A strong team can even “move fast and break things” multiple times before they get it right. A weak team won’t survive a first failure.

In crypto we at Hartmann Capital add community and tokenomics (in TradFi, all equity is structured alike) to the list. In markets dependent on the input of others – as liquidity providers, token investors, builders and marketers, to name a few – the strength and resilience of the community that coalesces around the project is almost as important as the team itself.

Terra stood out as the one ecosystem to watch for in the coming layer 1 wars. While incentives are driving adoption of challenger layer 1s such as Polygon, Avalanche and Fantom, Terra keeps growing on the back of a very strong community as well as great products and a target market that includes non-crypto natives.

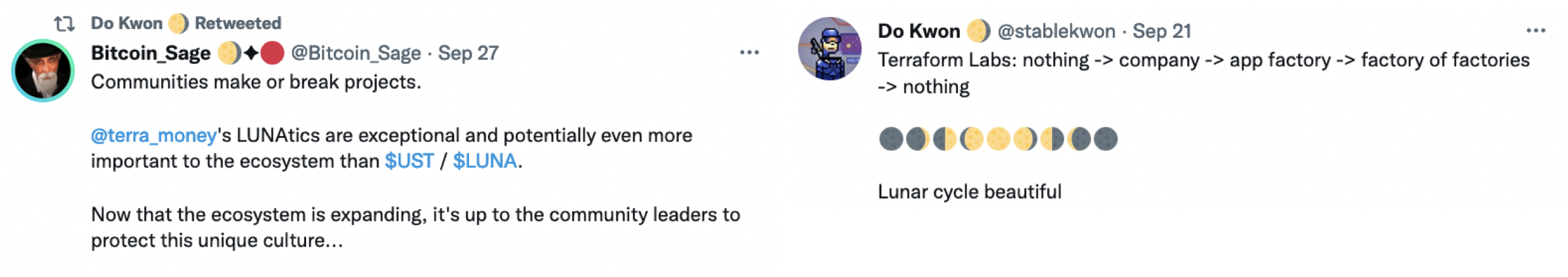

While it is true that Terraform Labs and its leader Do Kwan, have provided the leadership today, the conference and the TeFi Alpha showcase together revealed that the community is stronger than just the Terra founders.

The TeFi Alpha showcase may not have provided any specific instances of “true” alpha generation, it was clear that the community-driven sessions and events sparked interest and confidence in Terra. Terra’s native token LUNA was up 34% from the start of the showcase to the end of the Conference, moving even slightly higher from there.

Source: @TeFiAlpha, Coingecko

The community said all the right things, stressing the multi-chain world and interoperability. Do Kwan started with restating his laser focused commitment to growing the dollar-pegged UST stablecoin, on Terra, across chains and in fintech. While the initial products keep growing, such as Anchor and Mirror, a full ecosystem for DeFi and the metaverse is on its way, if not already here.

TeFi Alpha gave us a sneak peek into some of the innovation that’s coming to the Terra ecosystem. Many developers have been patiently waiting for the Columbus-5 upgrade and now that it’s finally arrived, we are anticipating an explosion of new applications that will drive increased adoption of UST and LUNA. Here are three new DApps that we’ll be keeping an eye on:

Andromeda is a next-gen NFT Protocol that is reimagining NFTs as Andromeda Digital Objects (ADOs). The protocol is providing tools that let the average user build out a custom NFT Collectible without writing any code. We can’t wait for Andromeda to bring a wave of new NFT collections to Terra.

Alice is building the easiest on-ramp for the Terra ecosystem. Users in the US will have an easy way to convert fiat into UST. Best of all, $UST in the Alice app will automatically earn Anchor’s 20% stablecoin yield. In addition, Alice is planning on launching a debit card that makes it just as easy to spend UST in everyday transactions. Alice is planning on launching in November 2020, so stay tuned.

Levana is building a platform that will let users LEVerage ANy Asset, including MIR, ANC, MARS and MINE. Their first product will allow users to swap LUNA for a 2 time leveraged LUNA2x. Levana has an ambitious roadmap with plans to introduce cross-chain leverage, options, and perpetual swaps.

Additionally, there was a lot of excitement surrounding Terra’s Columbus-5 upgrade, since completed, that enables the DApps-in-waiting to finally launch.

Bridging, a critical component in the multi-chain world, will be improved under C-5 through Cosmos’s IBC, while Wormhole v2 will allow Terra to bridge to and from Ethereum and Solana.

Do reiterated at the conference that he will be ecstatic when the community can finally take over the Terra platform. As he tweeted (and retweeted):

The conference and the events increased our conviction on LUNA and many of the DeFi tokens. We believe not only that Terra has the potential to be one of the few multi-purpose chains in the multi-chain world, but also that the team and the community have onboarding the mainstream as the ultimate goal. Terra’s first fintech/crypto crossover product was Chai, for Korean stablecoin payments. The success of UST and stables in other currencies will depend on real world use cases. They are coming.

Terra was not the only layer 1 that brought a community feel and a simple yet compelling focus to the conference. Solana, another Hartmann Capital favorite, is building on its reputation as the strongest Ethereum-challenger chain for high-speed low-gas DEXs, focusing on order books and other features that are difficult to implement or too expensive on Ethereum. At the conference, without the presence of Do’s opposite number, FTX’s Sam Bankman-Fried, we felt that Solana stood out as more of a community than one company or even one man. Sino Global Capital showcased four new Solana protocols on Sunday. Two of these, Solana DEXs Orca and Mercurial, made big impacts at the conference. A more robust money market industry is required to facilitate DeFi shorting and leveraging. The first-ranked lending protocol on Solana, however, only has $150 million in TVL, so Solana’s Jet Protocol will be value-accretive to the ecosystem.

We felt that some of the chains that have been growing due to massive incentive programs didn’t argue their cases as eloquently. Avalanche resorted to an ice cream truck for attention. Several others couldn’t articulate a compelling USP. Can someone please tell us what the difference is between Fantom and Harmony (for example), or Near and Algorand, or any of the others who are giving away none or ten-figures in incentives?

Nevertheless, layer 1s have had quite the run recently.

Source: Coingecko

While we’re unsure about how the multi-chain world will evolve, we feel confident that both Terra and Solana will be winners. While there will be others, it’s not clear who those will be.

3. Multi-chain is the future

That Ethereum will lose market share to challenger layer 1s was the cliche of the conference. It’s rational to expect a multi-chain world. It’s equally rational to believe that not all challengers will survive, never mind thrive. Nevertheless, with the jury still out on who will gain enough network effects to challenge Ethereum and/or attract entirely an entirely new user base.

Terra’s Kwan epitomized the feeling at the conference that:

Maybe it's a bad idea to stick all the applications into one global computer. Maybe it just makes sense to have a multi-chain future.

But it was a Cosmos proponent, Interchain engineer Tess Rinearson, that caught our attention with the remark that:

... a broader, more diverse group of projects involved … and they’re going to want to choose technology that’s optimized for what they want to do...And that’s where you start to see these application-specific blockchains.

Of course, many speakers and attendees are incentivized to believe in a multi-chain world, especially if they work for or have invested in the competitors, or operate within their ecosystems. Mainnet’s sponsors included smart contract platforms Celo, Harmony, Algorand, Secret, Terra, Polygon and Akash. So how did we separate reality from hype?

At Hartmann our thesis on multi-chain has always been that specialist smart contracts will emerge to serve specific clientele. This is obvious with Solana, and slightly less obvious with Terra. Yet Terra remains focused on uses for its stablecoin technology. Layer 1s, 2s and side chains are focusing on one or a few related DApps, such as Immutable X with God’s Unchained and related NFT games, and Flow with NBATopshot.

Arweave and Secret

But there are other chains that are carving wider niches. Hartmann Capital investments Secret Network and Arweave are examples of specialist chains that are currently unique in their space. Nobody is currently focused on permanent storage, and we view Arweave’s service as a crucial component of Web3, especially news platforms.

Secret Network is currently the only live privacy layer 1, though others such as Dero will be arriving shortly. If Secret can use its first mover advantage to prove privacy use cases for DeFi and NFTs, we think it can establish the required network effects. A little “alpha” from the conference is that Secret was the only non-Terra protocol that had a slot at TeFi Alpha. Is this an indication of future collabs between Terra and Secret?

Cosmos IBC

Terra and Secret are both built using Cosmos SDK, and the final revelation at the conference, as we explained in last week’s newsletter, was that Cosmos is ready to go mainstream, with its Osmosis DEX and Cosmos Hub native bridging. Two “layer zeros” are competing for ulti-chain interoperability, Polkadot and Cosmos. Both were well represented. Pokadot’s Gavin Wood was impressive, as one would expect from Ethereum’s first coder. But Cosmos convinced us that they are on the rise, even as Polkadot has yet to go live. Akash, Band and Injective are three other layer 1s that live in the Cosmos Ecosystem.

While the ATOM token has yet to have appropriate tokenomics, we are closely watching Cosmos space for any changes that warrant a second look at the native token. In any event, layer 1s and DApps using Cosmos will be at some advantage in the multi-chain world.

The Multi-chain future

While the multi-chain world is here, not all L1s and L2s will survive. Community matters. The best devs will go where the users are. The best communities will become better communities as more users and devs are drawn in. besides sponsorship and community, use case matters. Chains that can dominate a use case – ultra fast exchanges for Solana, UST “TeFi” for Terra, Arweave for permanent storage – will have the best chances. Ethereum will likely continue to grow: It’s the dominant chain for DeFI and high-value NFTs. Again, it’s the ecosystem. There may even be room for some all-rounder chains, so-called Eth-killers (Avalanche?). For others, we expect a bloodbath.