Metaverse Summer

The revolution has arrived. It’s not just the Boomer’s crypto anymore, and it’s more than finance that is getting disrupted. Granted, crypto assets continue to grow: as stores of value, for payments and as fuel for DeFi’s ongoing attack on TradFi. Bitcoin is still 262% up over twelve months, and DeFi has stabilized recently at around $66 billion total value locked, up 17x in one year.

There is no denying, however, that there are headwinds for DeFi. While the pre-Cambrian explosion around the time of “DeFi Summer” 2020 focused developers and investors on disrupting TradFi and even coexisting with and potentially replacing fiat (e.g. El Salvador) however, few were paying attention to the potential of a decentralized “metaverse”.

The metaverse has many definitions. In its simplest form, it is a virtual online multi-user space. Roblox is perhaps the best example of the continuing journey towards the ultimate metaverse experience. Its social world allows users to participate in a variety of user-created virtual experiences, or they can create their own.

In crypto we think of the metaverse in broader terms, including not only virtual worlds, but also collecting art and playables, gaming and gambling and even the platforms we use to mint, collect and trade the mostly non-fungible tokens representing all the elements of all of these worlds.

It’s likely an urban myth that Vitalik created Ethereum as a response to his loss of a beloved fighter’s powers in the heavily-centralized World of Warcraft. Nevertheless, behind the scenes, crypto devs have been working for years to decentralize gaming, collecting and social networking. The ultimate goal of the decentralized metaverse is not only to create vibrant platforms but to allow all users full ownership and control of personas, avatars, game assets, art, places and rewards – all accessible on a blockchain in the form of non-fungible tokens (NFTs).

Perhaps sensing a growing threat from crypto and the growing global movement to online activity, Facebook made headlines this week by announcing that their vision of the centralized monopolistic future will be based in their heavily centralized and likely advertising-driven “metaverse”. Zuck’s virtual worlds will be powered by its own hardware and software, and live on Facebook’s servers. No word yet on how the company will protect our privacy.

The response from crypto to Facebook’s announcement has been unanimous and best articulated by early crypto founder Stani Kulechov’s tweet:

Until the breakout this year that is culminating in “Metaverse Summer” 2021, decentralized gaming and collecting was a story of unfulfilled ambition. What is now the most popular crypto game, Axie Infinity, was launched in a centralized manner in 2018, though the Axies could be held as NFTs on Ethereum. Axie Infinity then languished for years until well into 2021, when it migrated to a lower cost chain. Indeed, the entire metaverse was held back by high gas costs on Ethereum.

Source: Coingecko, Dapp Radar.

Even DeFi lost some of its economics due to block congestion as transaction growth and value added metastasized.

Collectibles: From CryptoKitties to the Metaverse

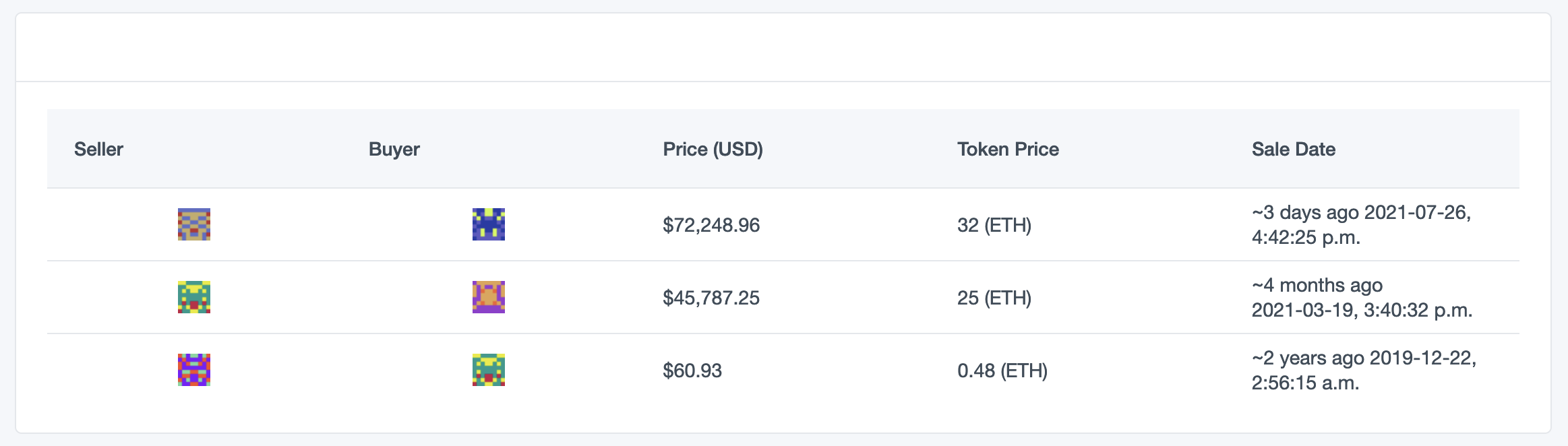

Crypto OGs are also often gamers and collectors, and so blockchain-native collectible art was a natural fit for the newly-wealthy. Gas prices for them are less important. Beginning with Crypto Kitties, through Cryptopunks and up to Meebits, Bored Ape Yacht Club and Stoner Cats, a wall of crypto has been chasing the opportunity to flex on other OGs, resulting in massive price inflation as a self-fulfilling prophecy, directly rewarding creators. This CryptoPunk has increased in price 1200x (in $ terms) in only 19 months:

Siurce: Non-fungible.com.

NFTs offer the potential for provenance to be documented, identity to be proven, transfer to be inexpensive, transparent and flawless, and royalty revenue to accrue decentrally and automatically. As in real life, the form and function of digital art varies immensely.

While crypto users focus on the cachet of digital art, non-crypto natives have been focused on crossover work. Musical artist 3LAU minted NFTs linked to various services only he can provide, establishing a direct connection with his fans. Most recently, Ashton Kutcher and Mila Kunis have crossed over with an NFT series that exclusively unlocks a series of animated shorts called Stoner Cats. True to crossover form, Ethereum-founder Vitalik Buterin has a speaking role:

Source: StonerCats.com.

If NFTs are creators’ gold, NFT minting, trading and management platforms (NFTaaS) provide the picks and shovels, mining resources and the markets. While predicting which creators and creations will succeed in the long term is always fraught with issues around tastes and trends, those facilitators who are able to capture network effects may do well if the growth in NFTs continues, no matter the tastes of the consumers and users.

Platforms have perhaps seen the best traction among the VCs. OpenSea became crypto’s first “unicorn”, with a valuation of just over 1.5 billion on its latest fund raise this month. Platforms that either pool NFTs into “funds” or fractionalize existing higher-value NFTs are also gaining in popularity. The WHALE token (facilitated by Roll) and PUNK_BASIC (Set Protocol) reference portfolios of NFTs, while Fractional is aiming to provide exposure to high-value NFTs to the average investor.

High value metaverse assets such as collectable avatars Cryptopunks and Meebits and high-end NFT art were able to grow last year, as they could still trade on the secure but expensive Ethereum layer 1. But lower-value metaverse transactions (e.g. a card or a sword) were uneconomic, especially when gas fees reached into the 100s of dollars.

Games: Cheaper, faster, more addictive, more profitable

The arrival of side chain Matic/Polygon allowed the cheaper and faster transfer of in-game assets (Decentraland), mining of asteroids (Cometh), and the care and feeding of tamagotchi-like Aavegotchis. Card game Gods Unchained launched on Immutable X, a ZK rollup layer 2 sharing Ethereum’s security but at much lower cost. Cryptoblades launched on the low cost Binance Smart Chain. NBA Topshot collectibles are on the Flow layer 1. Pokemon-like Axie Infinity launched on its own Ronin side chain.

Play to earn and speculation

Some of these metaverses are highly addictive, but some can also be very lucrative, for players and speculators. Though Axie Infinity is the best-known game in the play to earn (P2E) space, other addictive games such as Gods Unchained and CryptoBlades (see below) are emerging as sources of income. Playing in other realms can earn both fungible and non-fungible rewards that can be monetized. Participating in the Aavegotchi DAO, for example, earns points that make the ‘gotchis more valuable.

Source: Twitter via Gods Unchained.

Axie Infinity’s ability to generate pleasure and cash has caused its user count and revenue to skyrocket:

Source: Token Terminal.

Axie Infinity’s success has sparked a search for the next big thing in the space, while the pause in DeFi has forced crypto wealth to look elsewhere for value. Metaverse tokens have mostly all risen in sympathy with Axie, outperforming other crypto assets.

The Metaverse Index has more than doubled in a month while the DeFi Pulse index is roughly unchanged.

Source: Coingecko.

As the potential of earnings rise, the in-game assets rise in value. The best Axies now trade in the mid six-figures in dollar terms. A very-rare Triple Mystic sold for over $700,000 this month.

High prices can choke off demand for a game. Yet asset speculators have stepped in to rent valuable tools to the best players. Blackpool provides Sorare football/soccer cards to managers, Axies to the best Axie players, and Cometh in-game assets to the best miners. Yield Games Guild will also do the same for Axies.

As the sheer number of collectibles, platforms and games multiplies, specialist managers have been establishing decentralized and centralized products to leverage their own skills by profiting from investment interest. Prolific crypto entrepreneur Julien Bouteloup is backing Blackpool, whose BPT token references portfolios of managed in-game assets as well as NFT artworks. Delphi Digital is launching a $5 million on-chain fund in collaboration with noted Twitter NFT expert gmoney.

Investing in the metaverse is more complicated than other crypto themes such as DWeb and DeFi. New trends in gaming and collectibles have always emerged unpredictably and at light speed and in crypto the timelines appear to be even faster. What will catch on? What has long term value accrual?

Source: CryptoBlades.io.

CryptoBlades is an ideal example of how an addictive P2E game comes to market in crypto time. Gamers themselves, the Hartmann Capital team were able to quickly determine that CryptoBlades had potential, and we were able to momentum trade the game’s SKILL token to catch at least part of the initial pop. However, we see the CryptoBlades ecosystem as far from complete. As both the most used crypto dApp and the most active NFT marketplace in the world, CryptoBlades is earning profits on hundreds of thousands of items sales, and will soon be unlocking countless new streams of income from PvP arenas to consumables, raids, and even adding a virtual world with purchasable land through their add-on game, Kings.

Source: Coingecko.

By the time the game or collectible hits the mainstream, it could be too late. Yield Guild Games’s token distribution sold out in 30 seconds, making the initial VC’s an unrealized profit of 50x. Stoner Cats experienced such demand that it temporarily caused Ethereum gas prices to skyrocket.

Not everything moons, even in the current bull run. It’s still a risky space, and some projects fail to live up to their hype. Decentraland’s MANA token ended the second quarter down 50%, even as metaverse real estate is booming, and some competitors, such as Sandbox, have been gaining traction.

Decentralized gaming involves different elements and different considerations than its centralized equivalent. In gaming, popularity is obviously a major issue. But only certain games will grow beyond the early adopters. Axie has been able to break out, but for how long? Pokemon-style games are the easiest to execute in a decentralized manner, and have resulted in the biggest successes to date.

Source: Dapp Radar.

The metaverse holds unique investment hurdles. Obviously, collectible values are a matter of taste, trends and resources. A “floor” CryptoPunk trades at a small fraction of a rarer one that is solely accessible to crypto whales. Is a Meebit worth more than a Punk? What makes one Chromie Squiggle worth more than another?

With games, there are very different investment propositions. There are tokens to be used for governance, utility, and rewards. In Axie Infinity there are NFT players, accessories, land and land features.

The genius and popularity of Axie Infinity distracts from the unfortunate fact that successful games are in the fat tail, and the average game generally loses traction quickly and fades away.

Virtual Worlds and Real Estate

The metaverse requires spaces to interact, whether it is to game, create and/or socialize. Axies will be playable in a specialized metaverse, Lunacia. Creatives favour Somnium Space and Cryptovoxels, where virtual architecture, galleries and unique experiences are in its earliest stages of development. Basic NFT galleries, such as those at Lazy.com allow for limited interaction. The decentralized Second Life-like communities such as Decentraland are attempting to gain traction, but face headwinds. Unstructured social worlds are difficult to scale beyond its earliest adopters.

Whereas MANA and some other metaverse tokens have stalled due to disappointing early results, land itself has mirrored the real world in terms of the spoils of real estate speculation. Axie land is up 14x YTD in $ terms. Decentraland land was offered when “terraformed” in 2018 at $100 per plot. Though prices had stabilized recently in USD, an early adopter in 2019, 18 months ago, would still have a 12x return, dwarfing real estate profits in the real world.

Source: Non-fungible.com.

Republic Realm, backed by Novogratz’s Galaxy Digital, aims to be a virtual world real estate developer, and has been linked to a purchase of $1 million worth of Decentraland land last month.

Many games allow for holding land and building in their metaverse, such as Axie Infinity and, soon, Aavegotchi. For others land is a prime focus of the game, such as Decentraliand, Somnium Space, Cryptovoxels and Sandbox.

For now, however, we mostly need to use our imaginations on what is possible for virtual world real estate. We’ve run through the metaverses with land rights. Axie’s is still in beta, but early testers reported fun times. Decentraland remains mostly empty: Even the most well-known storefronts are mostly deserted. Sandbox has yet to launch.

Hartmann Capital and the Metaverse

Hartmann Capital believes that whoever optimizes for user experience will eventually control the many emerging markets – games, collectibles, art, music and spaces – when the dust settles. The moat is fandom.

While many allocators will opt for a “picks and shovels” approach, they miss the point that tools and platforms are commodities, and usually free in the centralized web 2.0 digital world. NFT marketplaces will face a race to 0, vying for customer attention, while open worlds will spawn in mass and face an uphill battle fighting for developers to build on their world, when the best game devs will desire to build their own. As a result we find neither open worlds like Decentraland, nor NFT marketplaces like Rarible that interesting. The latter can make for a good value investment should earnings arrive, and if they accrue to land or to tokens or users. Currently they do not.

What is more likely is that strong P2E games with large fan bases will evolve to have their own open worlds that developers can build on. Unlike the bland open worlds, a P2E associated world has the most valuable resource to offer: millions of users.

P2E games have had no problem developing their own marketplaces. Why would CryptoBlades or Axie Infinity, with 7-day volume of $182 million, share revenue with Rarible when they already have the users on-site?

Source: Axie Infinity.

In fact, the best games are likely to attract devs who build on top of the UX on offer, including third-party NFT creators.

As a result we find that P2E is the proof of concept to spawn metaverses. And each metaverse may end up developing its own land, its own marketplaces, and maybe even its own chain, as in the case of Ronin. At the same time, games will need to evolve with their users, offering different experiences to different players. Some will choose to be more social, others to battle harder, still others will be in it for the money. Aavegotchi plans to build games, socials and spaces on top of their current collectible marketplace. For all of its early success, CryptoBlades will need Kingdoms or minigames to add variety.

We plan to win the Metaverse by finding games that can have the potential to command the most loyal audience, then back them and help them Blitzscale from a simple game or concept into a vast virtual world, and virtual economy.

The success of Axie Infinity was a wake up call for investors in the decentralized gaming space, and has driven Metaverse tokens generally much higher over the past month. “Copycat” avatar NFTs are selling out no matter what the supply and subject. Whales and apes who got in early are often profit-motivated, and manipulate games to gain and keep their advantage.

We know, however, what happened after DeFi Summer: A year of parabolic growth in usage and in prices, followed by a recent consolidation.

Will Metaverse Summer lead to the same result for games, collectibles and virtual worlds? One thing is certain: We are still early in the metaverse’s evolution. Some things will fail. But hurdles will fall as more dev energy is devoted to the space. Hartmann Capital intends to be invested in the future as it happens.