Who Wins in a Multi-chain World?

It is now almost inevitable that we will live in a multi-chain world. Ethereum’s security will always come at a premium, forcing lower-value transactions onto other platforms.

While Hartmann Capital has historically been focused on the Ethereum ecosystem, we have also been investing in and on other layer 1 blockchains. While in the short term we will make momentum trades based on catalysts such as new incentive programs, our thesis is that long term success will come from the chains that can have unique and compelling competitive advantages over the others.

The Multi-chain World

Ethereum blocks are full. Aggressive minting of NFTs (September) or heavy DEX trading (May) continues to send gas prices through the roof.

Source: Messari

Applications requiring low value and/or high-frequency transactions are impractical with high and volatile gas charges. Yet as late as last December there were few if any options for DeFi or the metaverse off of Ethereum. There was Ethereum and Binance Smart Chain (BSC). Some started their own not-so-decentralized chains, such as NBA Topshots on Flow.

Development suffered. Protocols for collecting, gaming, betting and order-book trading all awaiting less-expensive chains. Non-whales had an expensive time interacting with complex smart contracts - the most expensive from a fee perspective but also the most lucrative in size.

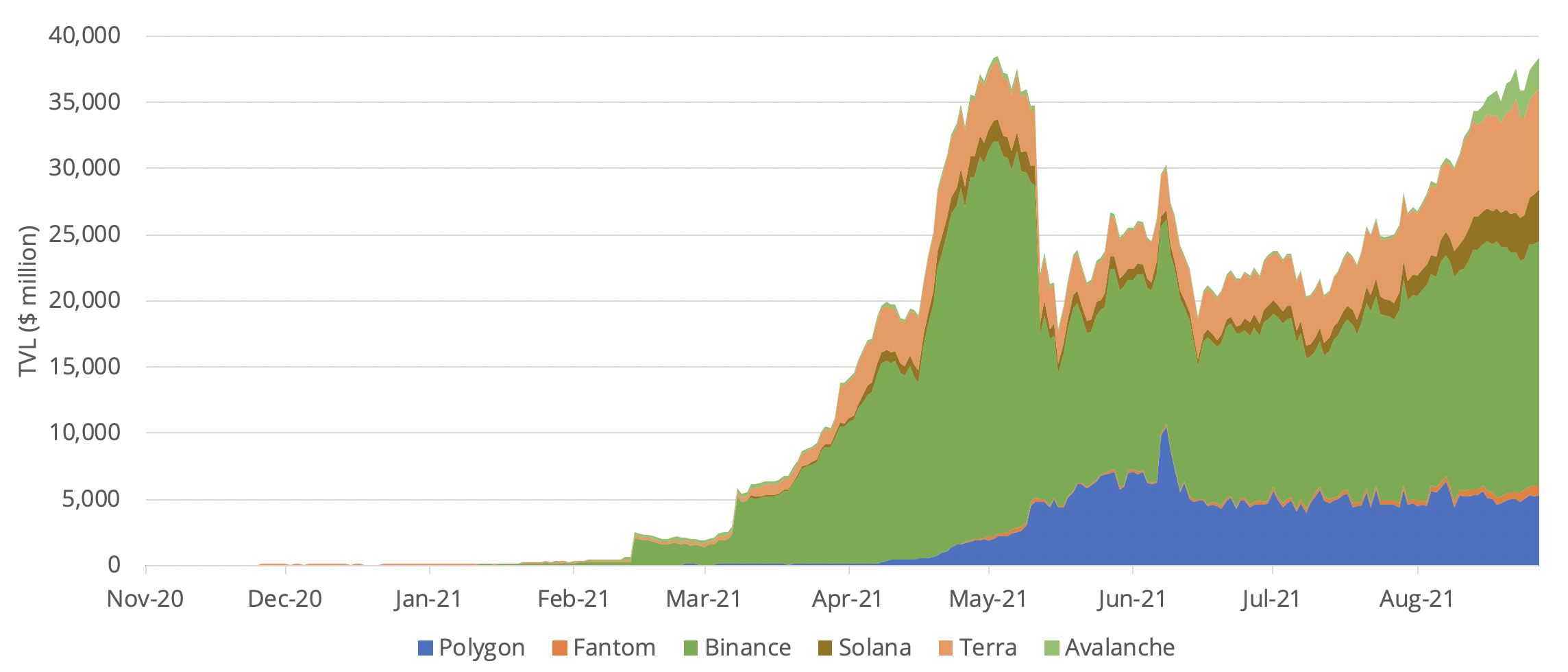

All that has changed. There are now an incredible number of challenger layer 1s, some of which are rapidly growing TVL.

TVL in select “Eth-Killer” layer 1 blockchains. Source: DeFi Llama

At the same time, “layer 2” scaling solutions that share Ethereum’s security are starting to gain tremendous traction.

Source: L2fees.com

But the universe of potential Eth killers and partners is staggering, and the daily news and price noise can be confusing and distracting. Here is an incomplete list of layer 1s.

Source: Messari

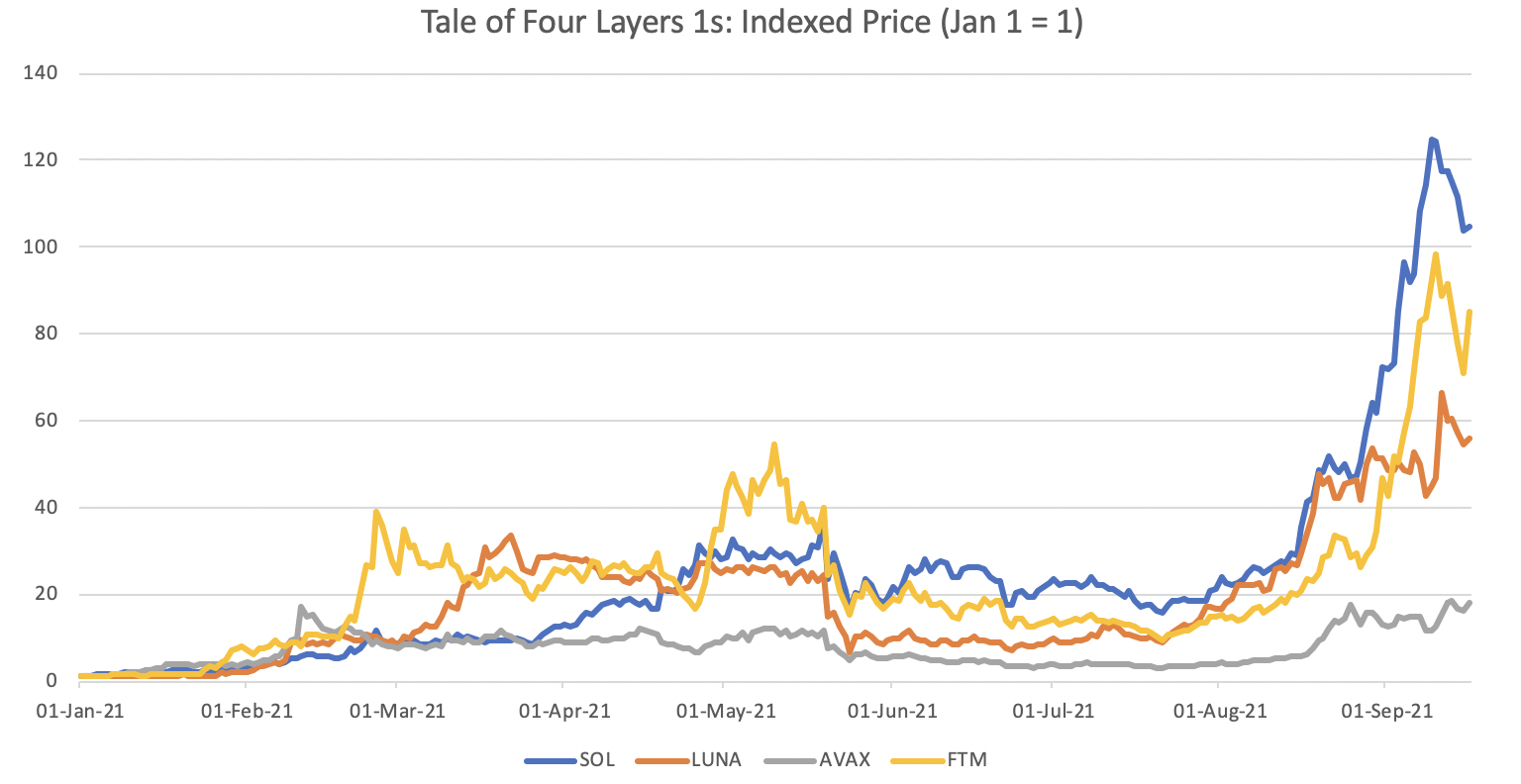

What is certainly obvious from the above table is that investors believe that there will be many winners. Two dominant challengers (e.g. Solana) are up 60-80x YTD, while even a few less impressive platforms (e.g. Algorand) are up 5-13x. Cardano, where smart contracts were launched only this week, is second only to Ethereum in market cap, and is up 14x YTD.

Source: Coingecko

While we believe that the price moves in LUNA (Terra) and SOL (Solana) are justified, it is less clear that FTM and AVAX moves (and others) make long term sense. Avalanche’s tailwinds are an aggressive incentive rewards program, EVM compatibility and significant venture backing. They already have a full if nascent DeFi and NFT ecosystem. Fantom is attempting the same feat as Avalanche, but TVL has not yet arrived. Can either of these latter two establish themselves in the face of aggressive competition all around?

We at Hartmann Capital want to be able take advantage of the price momentum of challengers as they scale (e.g. FTM), but at the same time want to prioritize layer 1s that have fundamental value in the long term. Who will still be a smart contract platform of choice next year? In five years? How do we profit from our expectations?

Source: Messari.

Here we contemplate what will make a layer 1 successful in the long run, and explain Hartmann Capital’s investment thesis in the space. It turns out that, sometimes, token price momentum is backed by fundamentals - the best of both worlds.

Ethereum

It must be said that we do not believe that any chain will flip Etheruem in the near future. There is an incredible amount of traction on the chain, and rollups will scale lower value transactions. Order book markets and collectible/card games are using ZK rollups, while optimistic rollups have fully-populated DeFi ecosystems. Devs build where the users are, and vice versa.

But it is always worth hedging a bet on ETH. After all, things move fast in crypto, as Ryan Watkins of Messari eloquently stated:

If Ethereum is any guide, fundamentals can change very fast. 18 months ago Ethereum was settling less than $1 billion in transactions per day, storing less than $20 billion in assets, and hosting just hundreds of applications with any activity (if that). 18 months later the ecosystem has grown almost two orders of magnitude on the back of breakout applications, incentive fueled growth, and one of the strongest bull markets in this industry’s history. Could Ethereum’s competitors replicate this growth in the next 18 months? Could they even grow faster? This is the bet smart contract speculators are making.

Ethereum dominance has definitely fallen. There have been both very good reasons and some less rational drivers.

On one hand, we need scalability in blockchains. This can come either from scaling Ethereum directly in layer 2s, as above, or by migrating to other layer 1s. On the other hand, incentive rewards have driven users to Polygon, Avalanche and now Fantom. Others have announced or will announce incentive programs as large or larger: Harmony, Celo, Hedera Hashgraph and Algorand, to name but a few.

However, based on TVL, users and DeFi ecosystem development, Solana and Terra are the only true potential Eth killers. Understanding what makes these two different from all of the other challengers is to understand our general investment thesis on layer 1s.

Our strategies

It’s no secret that Hartmann Capital, as a liquid hedge fund, engages in momentum trading. Almost always, however, we focus on trends backed by fundamentals and/or by a near-term catalyst.

We believe that layer 1 value will be driven by:

Great teams & communities - Well-led, well-resourced, laser-focused (but able to quickly pivot), and with compelling roadmaps, and a large community supporting and contributing to every move.

Great and battle-tested tech - both the layer 1 itself and the DApps on the platform,

A meaningful “warchest” - that is smartly deployed to build a better ecosystem rather than attract early adopters is a key to maximizing the benefits of the other two key conditions. Properly incentivized teams will build good product, and attract users in the long run.

Three of our favorite chains tick all of the boxes. In brief:

Ethereum - Largest community. Largest NFT and DeFi ecosystem. Network effects.

Terra - Well resourced. Very supportive community. Innovative DeFi ecosystem (e.g. Anchor offering 18-20% USD stablecoin yields).

Solana - Well resourced teams. Aggressive sponsorship. Innovative tech (e.g. Serum order-book exchange).

Secret Network, another layer 1 we believe in, is also an innovator, being the only current privacy chain that is fully deployed.

We’ve discussed Ethereum and its unequalled network effect and decentralization. But we are also long-term believers in the Terra and Solana ecosystems. Unsurprisingly momentum in the two native tokens is strong.

Not only is momentum far from the dominant narrative we select for, our conviction on both Terra and Solana allowed us to accumulate during the latest correction.

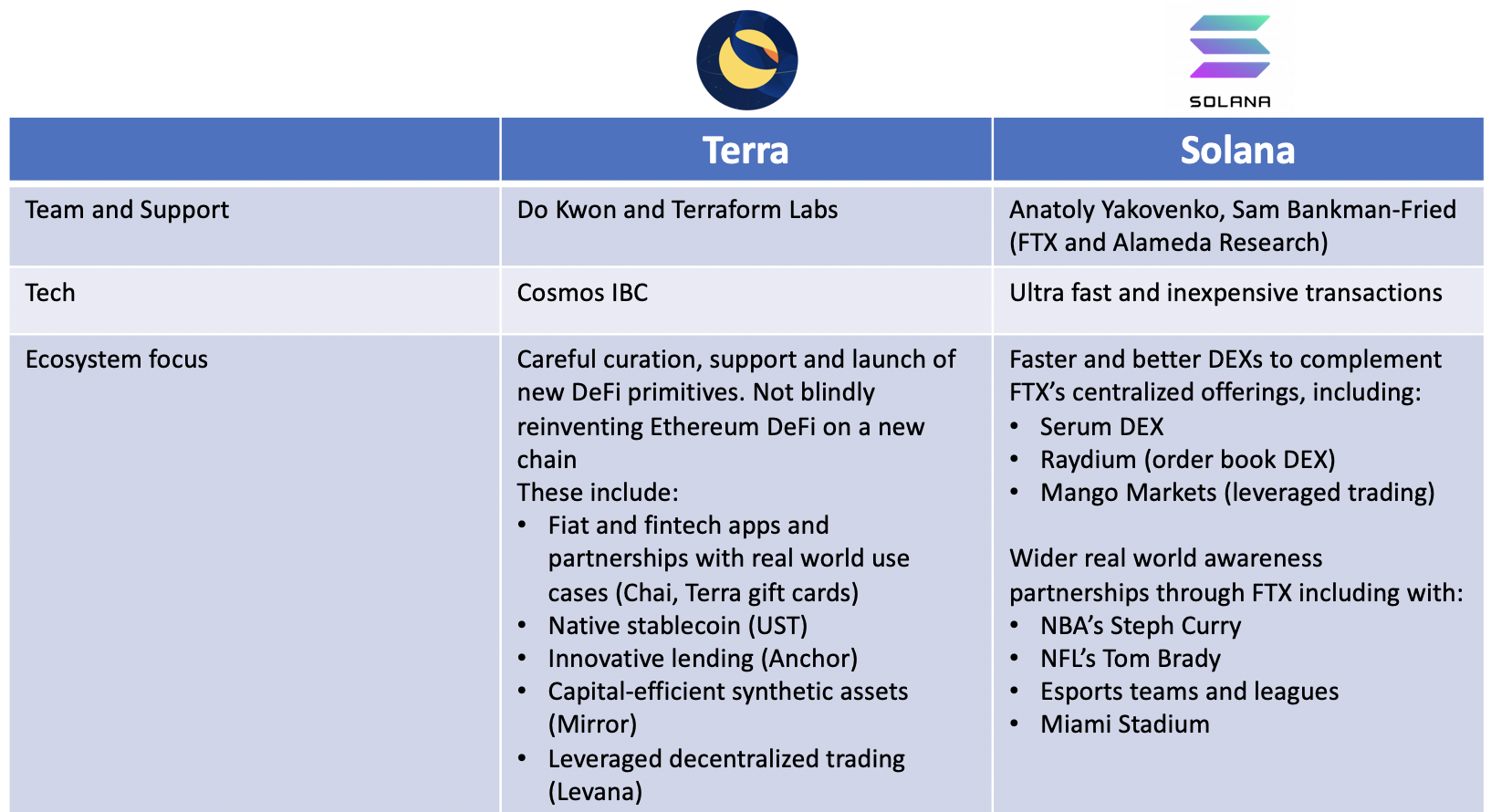

Solana and Terra

Solana and Terra are, on the face of it, completely different value propositions. At Hartmann Capital, however, we see them as remarkably similar. They both have strong leadership, technologies and communities. While they are both building out full DeFi and metaverse ecosystems, they each focus on a few USPs.

Terra, for example, has innovated across DeFi and payments use cases for its stablecoins, especially UST. The goal is to keep users in UST, and never leave the ecosystem. If successful, Terra will have a moat that will be difficult to breach. Terra is also committed to making it easy to suck in assets from other chains (and especially Cosmos chains) as well as to export Terra assets for use cases on, initially, Ethereum and Solana (e.g. Wormhole v2). It would not be surprising to see UST take over from Dai as the preeminent decentralized stablecoin.

Source: Terrians

Solana focuses on complementing FTX in DeFi. Both are strongly committed to onboarding the next generation of crypto users.

Terra and Solana each offer unique value propositions and the means and leadership to succeed. They are hard to bet against.

Investing in Our Layer 1 Thesis

There are three ways to play chain success, and at Hartmann Capital we are involved in all three.

Native token

Besides using the native token for fees, there is the option to hold and usually stake (or lend/farm) the layer 1’s native token. Running an eth2 node currently yields 5.4%. For the less sophisticated, Lido allows holders to stake without tech knowledge, but for less yield. Lido staking earns just under 5%, but the staked ETH can also generate yield elsewhere.

Staking Luna yields 3.9% when staked with a validator, but also earned Hartmann Capital airdrops in now highly-valued tokens such as Anchor, Mirror and Pylon, with more to come (e.g. Star Terra). Post the Columbus 5 upgrade, staking returns are expected to be in the double-digits.

Stalking and fee demand drive fundamentals for many of the top native tokens. Ethereum has a P/E ratio of 20x at current staking APRs, while Luna’s is closer to 25x. These compare very favourably to other growth opportunities.

DApp tokens

Every ecosystem has its winners, and when a chain has not yet reached its full potential, DApp tokens may equally be primed for growth. In fact, being early can be even more lucrative in the DApp space. DApps can also reap the benefits of incentives, on both sides: As devs directly, and through acquiring new customers. The Trader Joe JOE token, for example, outperformed the native AVAX token as liquidity was attracted to the dominant Avalanche DEX.

Source: Coingecko

Cross-chain protocols

Hartmann Capital also believes that established, battle-tested and popular brands can migrate to other chains, retaining and even growing their customer base as users bridge to the newly-incentivized ecosystems. Sushiswap, for example, has said it will deploy to all chains. Its SUSHI token, when staked as xSUSHI, accumulated fees from all protocols, regardless of layer 1.

Source: Sushiswap Analytics

Sushiswap is therefore chain agnostic, a good diversifying investment and hedge against the surprise rise to dominance of any one chain. Curve can also benefit from its brand across chains, but it is easier to fork. Ellipsis is an authorized fork on BSC, while unauthorized forks have appeared on Fantom and Solana. Between incentives and brand name, however, it could still do well.

We favor Sushiswap over other brand name protocols, due to the team’s track record of innovation way beyond its own origins as a fork of Uniswap.

Challengers

Beside Solana and Terra, who could win the layer 1 wars? We see a few prerequisites, especially for the smaller or non existent ecosystems. Firstly, incentives seem to matter. Solana might be the only chain that didn’t rely on massive rewards. Even Terra continues to subsidize its Anchor lending DApp.

Secondly, we believe that the shortage of devs and the difficulty in learning new tools will benefit Ethereum and EVM compatible chains. This is good news for optimistic rollups, Polygon, Fantom and Avalanche.

Some wildcards, such as Polkadot and Cardano, require specialized skills for devs. Both of these challengers are led by high-profile co-founders of Ethereum, yet have yet to provide any competition to the dominant chains. Questions remain. Will enough teams want to learn Haskell, or spend in advance in Polkadot’s parachian auctions? Is ICP just vaporware?

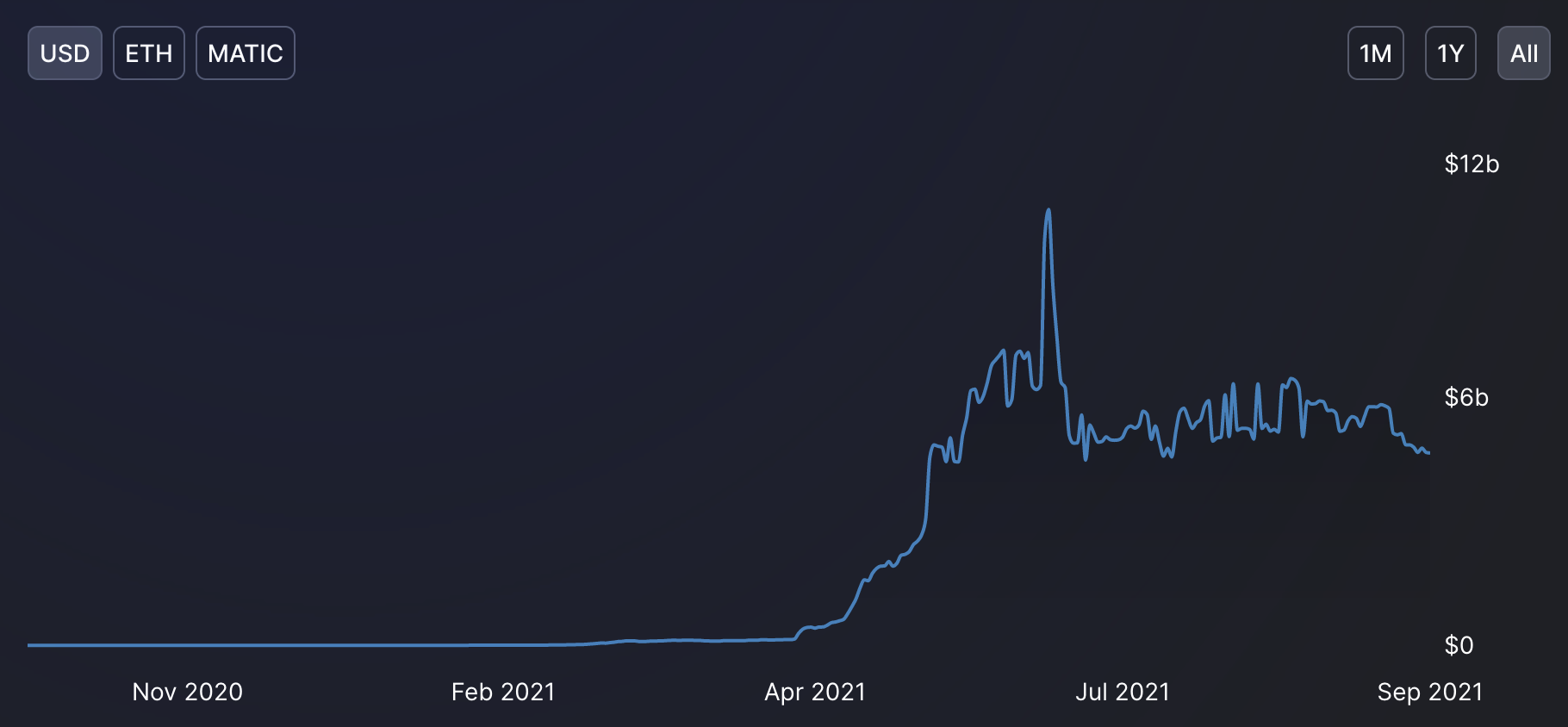

Thirdly, it’s important to understand why users are coming. For example, Polygon has stagnated now that user incentives have fallen.

Source: DeFi Llama

The MATIC token has underperformed in sympathy, down even in ETH terms since its peak in May.

Source: Coingecko

Will Polygon-style tactics work for other layer 1s? It appears most chains are going to try. Avalanche, Fantom, Harmony, Celo and Near all have nine- or ten-figure incentive programs. Some are also raising VC money to ensure success.

Avalanche TVL and token prices have skyrocketed since the incentives announcement.

Source: The Defiant, Decrypt, Coingecko

10m AVAX tokens currently worth over $600 million have been allocated to a multi-month incentive program that hasn’t even begun yet. Veteran brands Aave, Curve and Sushi, as well as Pangolin and Trader Joe, will be offering AVAX rewards. Riding Avalanche momentum is one thing, but where does the chain go from here? Can the other chains betting on incentives carve out their own niche?

VCs think so. Or?

Native tokens have been allocated to improve the chain, reward devs and community builders and incentivize users. Without team, tech and community, however, a layer 1 without a competitive advantage will likely end up like Polygon, or worse.

Layer 1s that fill a specific need that the other dominant chains cannot or do not meet can also do well. Terra and Solana do this well, of course. We previously highlighted Secret Network. We are also bullish on Arweave and its focus on permanent web3 and crypto storage.

Flow may continue to be a somewhat centralized blockchain for frequent collectors. NBA Topshot remains in the top 5 NFTs by volume. Flow’s support for creators gives it some competitive edge.

Without an edge like Arweave’s, Secret’s. Terra’s or Solana’s, it will be tough to break through into the multichain world for currently second-tier chains, especially if they are not EVM compatible.

Final Thoughts

The layer 1 and 2 landscape is incredibly confusing. It’s extremely unclear how the multi-chain world will evolve in the coming years. It took less than a year for Ethereum to dominate DeFi and NFTs. What will crypto look like a year from now? Or five years from now?

There are an unbelievable number of layer 1 and layer 2 challengers for Ethereum’s throne. In our opinion, however, many can be dismissed as purely meme-riven momentum plays. We do participate in those when the risk/reward is compelling, of course. It may be possible to buy devs and goodwill with native tokens, but eventually those apps have to consistently generate value for the ever more fickle users, who can now jump from chain to chain much more easily.

We at Hartmann Capital believe that, in the long run, fundamentals trump memes, pumps and even headline-grabbing user incentives. As such our higher-conviction and therefore larger allocations will be to those with real value added, Terra (LUNA) being one of our current core positions:

That is, incentives now appear to be a necessary but not sufficient condition. We focus on team, tech and community, and the leadership and dev community of Solana and Terra can be heard through the layer 1 noise. While we may be in and out of other layer 1s when opportunities arise, we continue to believe that a few chains have proven they have what it takes to succeed in the multi-chain wars.

Disclaimers:

This is not an offering. This is not financial advice. Always do your own research.

Our discussion may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.